The Stock Market: 2025-2029 Detailed Scenario

2025: Tech Surge and Initial Instability

The stock market in 2025 is characterized by rapid growth and occasional turbulence.

The year started strong as tech giants like Google, Amazon, and Apple reported record profits driven by continued advancements in AI and automation. Stocks in these companies soar, with Google’s Alphabet hitting an all-time high in February.

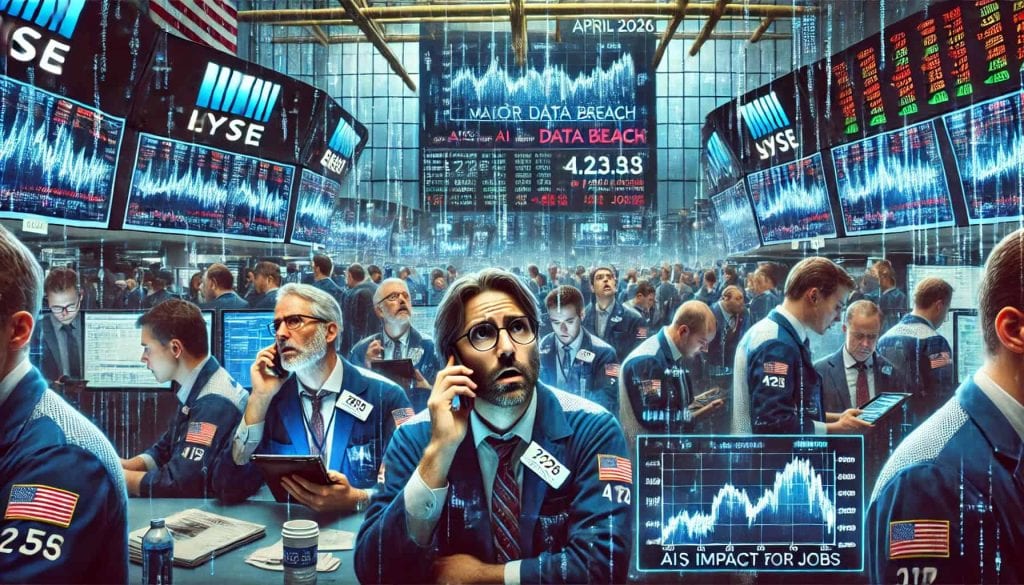

However, the market experiences instability as concerns about AI’s impact on employment begin to surface. In April, a significant data breach involving a major tech company causes a temporary dip in the tech-heavy Nasdaq.

Despite this, the overall market remains bullish, and the S&P 500 closes the year at a robust 6,500 points.

2026: Market Resilience Amid Growing Concerns

2026 sees the market maintaining resilience despite growing concerns about AI’s societal impact. Tech stocks continue to perform well, with companies like Microsoft and Nvidia leading the charge due to their advancements in AI and cloud computing. Nvidia’s stock, in particular, doubles by mid-year due to its dominant position in AI hardware.

Financial markets start to show signs of strain in other sectors. Retail and manufacturing stocks face pressure as automation leads to job cuts. Walmart and Target experience declining stock prices as they grapple with reduced consumer spending in certain demographics affected by job displacement.

By December, the DJIA reached 48,000, reflecting a market that is cautiously optimistic but increasingly aware of underlying economic shifts.

2027: Heightened Volatility and Regulatory Responses

2027 is marked by heightened market volatility. In January, a major government report highlights the growing unemployment crisis due to AI automation. This triggers a sell-off in tech stocks, with companies like Amazon and Facebook seeing significant drops.

The market begins to stabilize by mid-year as regulatory responses take shape. The government announced initial plans to introduce Universal Basic Income (UBI) and tax reforms aimed at curbing excessive automation.

Financial markets react positively to these announcements, with the DJIA rebounding to 49,000 by September.

Renewable energy stocks also see a boost as the government increases incentives for green technologies. Tesla and NextEra Energy experience substantial stock gains, driven by growing public and governmental support for sustainability.

2028: Precipice of Change

2028 is a year of significant transition. Tech stocks face mixed reactions. While some companies, like IBM and Salesforce, focus on augmenting human workforces with AI and see their stocks rise, others that heavily rely on automation, like Amazon, face investor skepticism.

Amazon’s stock price remains volatile, reflecting uncertainty about its ability to adapt to the new tax landscape.

The financial sector also transforms. Banks start adjusting their portfolios to align with new regulatory requirements.

Goldman Sachs and JPMorgan Chase pivot towards green investments, seeing steady stock appreciation. By year’s end, the DJIA stabilizes at 49,500, showing cautious optimism amidst the significant economic shifts.

2029: The Year of Collapse

The year 2029 begins with the stock market showing initial resilience despite mounting economic pressures. January sees a brief rally as companies report strong year-end earnings. However, as AI-driven layoffs accelerate, the market’s facade of stability quickly crumbles.

By February, widespread unemployment leads to plummeting consumer spending. Retail stocks, including giants like Walmart and Target, take severe hits.

Target’s stock, for example, loses 30% of its value within the first quarter. The tech sector also suffers as investor confidence wanes. Even resilient stocks like Google and Microsoft experience steep declines.

In May, several major banks announced they were on the brink of collapse, triggering panic in the financial markets. The government’s bailout packages were seen as insufficient. By June, the Dow Jones had lost over 50% of its value, plunging to below 25,000 points.

The summer months are marked by extreme volatility. Social unrest and political turmoil exacerbate market instability.

Stocks of security and defense companies like Lockheed Martin and Northrop Grumman see temporary gains due to increased government spending on maintaining order. However, these gains are short-lived.

As autumn approaches, the market continues its downward spiral. October witnesses a massive sell-off, reminiscent of the 1929 crash, further deepening the economic depression. By December, the DJIA stands at a precarious 18,000, reflecting the full scale of the financial collapse.

The Stock Market: 2030-2035 Detailed Scenario

2030: Volatility and Adaptation

The stock market in 2030 is a roller coaster. January saw a sharp rally as investors reacted positively to the introduction of Universal Basic Income (UBI).

Consumer confidence boosts, and spending increases slightly, leading to a short-lived uptick in retail stocks. Companies like Walmart and Amazon see a brief surge, but the optimism is tempered by underlying economic instability.

By mid-year, the market faces new challenges. The legislation tying corporate taxes to employee ratios creates uncertainty.

Tech giants like Google and Apple experience significant stock price fluctuations as they scramble to adjust to the new tax environment. Smaller tech companies, unable to bear the new tax burdens, see their stocks plummet.

July brings some stabilization as companies begin to adapt. Businesses that invest in human labor to mitigate tax impacts, like Tesla and Microsoft, see modest stock gains. However, sectors heavily reliant on automation, such as manufacturing and logistics, continue to struggle.

By December, the Dow Jones Industrial Average (DJIA) settles at a cautious 20,000, reflecting a year of turbulence and adaptation.

2031: Emerging Resilience

The stock market in 2031 shows signs of resilience. Retraining programs and new industries start to take effect, and renewable energy companies like NextEra Energy and Tesla’s energy division see substantial stock growth.

Government incentives and a societal push towards sustainability drive investor confidence in green technologies.

Tech stocks began to stabilize after a volatile 2030. Companies focusing on human-AI collaboration rather than replacement, like IBM and Salesforce, experienced renewed investor interest.

The retraining programs also benefit education technology companies. Coursera and Khan Academy, which partner with the government for retraining initiatives, saw their stock prices double.

The DJIA will climb back to 25,000 by the end of 2031. The market reflects cautious optimism as new sectors and adjusted business models gain traction.

2032: A New Wave of Industries

2032 witnessed the rise of new industries. Renewable energy remains a strong performer. Solar and wind energy companies, such as First Solar and Vestas, see their stocks soar.

Traditional energy companies like ExxonMobil pivoted towards green technologies, which led to mixed reactions from investors but an overall positive movement in their stock prices.

Healthcare stocks experience significant growth. The emphasis on retraining and expanding social safety nets boosts companies involved in medical technology and services.

Stocks of companies like Johnson & Johnson and UnitedHealth Group reach highs, driven by increased demand for healthcare services and innovations.

The tech sector stabilizes further, with companies focusing on enhancing human capabilities alongside AI seeing sustained growth. By December, the DJIA hits 30,500, marking a year of substantial growth driven by new industry leaders and adaptation.

2033: Continued Growth and Regulatory Shifts

2033 is marked by continued stock market growth and significant regulatory shifts. Environmental regulations intensify, leading to increased investments in sustainability.

Green building materials companies like Owens Corning and eco-friendly consumer goods producers like Procter & Gamble see their stocks rise.

Political reforms focusing on equitable wealth distribution impact financial markets. Banking stocks face initial turbulence as new tax policies are implemented but quickly stabilize.

Banks that adapt by supporting green and social impact investments, such as Bank of America and JPMorgan Chase, see long-term benefits.

Tech stocks continue to perform well, especially companies pioneering ethical AI practices. Nvidia and AMD, leaders in AI hardware, see substantial stock gains.

The DJIA will reach 34,000 by the end of 2033, reflecting a market buoyed by regulatory clarity and continued growth in new sectors.

2034: Environmental and Technological Synergy

Environmental awareness peaks in 2034. Companies heavily invested in sustainability see their stocks outperform.

Renewable energy firms and green technology companies dominate the market. Tesla, branching further into sustainable transportation and energy storage, sees its stock triple.

Tech companies focusing on privacy and ethical AI practices also benefit. Firms like Apple and Google, which lead in setting industry standards for data protection and AI ethics, see steady stock appreciation.

The healthcare sector continues its upward trend. With increased funding and innovation, companies like Pfizer and Moderna develop advanced treatments and preventive measures, driving their stocks to new heights.

By December, the DJIA stands at 39,000, reflecting the synergistic growth between environmental initiatives and technological advancements.

2035: A Balanced Market

The stock market will find a new equilibrium by 2035. The concept of work and economic participation has evolved.

Companies that successfully integrate human-AI collaboration and focus on sustainability will lead the market. Tesla, NextEra Energy, Apple, and Microsoft are among the top performers.

The financial sector adjusts to new regulations with mixed results. Banks that embrace green investments and support small businesses, such as Goldman Sachs and Citigroup, see steady growth.

Traditional retail stocks like Walmart and Target rebound as consumer spending stabilizes due to UBI and a recovering job market.

The DJIA closes the year at 41,000, marking a period of significant transformation and adaptation. The stock market reflects a world where technology and humanity find a harmonious balance, driven by sustainability and ethical practices.

Disclaimer

This text is a fictional scenario describing a potential depression in the stock market in 2029. Any resemblance to real events, entities, or individuals, including mentions of specific brands, companies, or market trends, is purely coincidental. The information provided is speculative and should not be construed as financial advice or a prediction of future events. Always consult with a professional financial advisor before making any investment decisions.